cryptocurrency tax calculator india

The Indian government is planning to compartmentalise virtual currencies and their tax treatment on the basis of their use case payments investment or. Please tell us if the tax department is using any tools to track cryptocurrency transactions in India.

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win

It may sound like a negative news but lets dig in a little deeper and find out what are the facts about cryptocurrency tax in India.

. BearTax - Calculate Crypto Taxes in India. Reporting of cryptocurrency holdings in ITR If an individual qualifies as resident and ordinarily resident there is a requirement to report foreign assets under schedule FA Details of Foreign Assets and Income from any source outside India. Because there is no further deduction that will.

Tailored as per the Indian tax laws the algorithm provides an accurate report of your crypto gainslosses for a. The income tax liability calculated above is only for income earned from bitcoins. According to the Budget 2022 announcement Tax Deducted at Source TDS will be imposed on payments for the transfer of crypto assets at a rate of 1 for transactions over a certain threshold.

Enter your total buying price of all the cryptocurrencies that you acquired. Cryptotaxindia cryptotax cryptocurrencytaxHow to calculate Cryptocurrency tax in CoinSwitch Kuber on crypto gains. This novel transnational currency has led to the rise of some massive tax opportunities for several countries and governments along.

To calculate tax on cryptocurrency you have to deduct the purchase price from the selling price of cryptocurrencies you hold and calculate 30 of the value. For example if you bought Rs 50000 worth of Bitcoin BTC and Rs 60000 worth of Dogecoin DOGE enter 110000 in the Total Buying Price input field. The cryptocurrency tax calculator tool therefore can be used to simplify the process of computing tax liability without the hassles of manual computation as well as reducing the time taken for the same.

Taxation on Cryptocurrency These examples calculate taxes for the FY 2022-23 for a person. From April 1 2022 cryptocurrency profits have been taxed at 30. Of India has introduced a scheme for taxation of virtual digital assets including bitcoins cryptocurrency.

If yes what are they. How will cryptocurrency earnings be taxed. Analysts picture four scenarios in which crypto assets can be taxed in India.

How to calculate your crypto tax in Canada. If your income includes income from sources other than cryptocurrency or NFTs tax on such income needs to be calculated based on the applicable income tax slab rates. Just by entering a few basic details on the calculator one can ascertain the short or long-term capital gains tax depending on the holding period.

However the Government has not clarified what this threshold will be. Crypto Tax Calculation Formula in India. Finance Minister Nirmala Sitharaman said that any income from transfer of any virtual digital asset.

Please refer to the example below. Indias first crypto accounting and tax tool which has been vetted by a Chartered Accountant. Typically every RTI receives a response after 3 weeks sometimes exactly on the 30th day which is the last day for.

The trading volume of cryptocurrency in India has increased by 400 percent in the last few months during the nationwide lockdown due to the COVID-19 pandemic. 30 tax on cryptocurrency income brings clarity legitimises crypto say experts. Following are the steps to use the above Cryptocurrency tax calculator for India.

Please tell us how does a trader need to calculate tax for profits made from Cryptocurrency trading. Heres how to calculate tax if investing in cryptocurrencies and NFTs in India. In addition to 30 of the tax you also need to pay cess at 4 of the tax amount.

30100 CryptoCurrency Sale Price CryptoCurrency Buy Price The Union Budget 2022-23 has proposed a 30 tax on cryptocurrency assets. In the Union Budget 2022 crypto assets have been classified as virtual digital assets. A Bitcoin tax calculator is a tool that helps Bitcoin owners automate the calculator of short-term capital gains tax and the long-term capital gains tax on profit from bitcoins.

The capital benefits tax is then levied on the income of a countrys Indian relative to the cryptographic income. 1 TDS on Crypto Assets. The ClearTax Bitcoin Tax Calculator shows you the income tax liability on cryptocurrency income.

How To Use The India Cryptocurrency Tax Calculator. Crytpo Tax 30 of Crypto Profit. As per budget 2022 you will have to pay tax 30 on profit on the sale of any virtual digital assets cryptocurrency.

BearTax is integrated with more than 25 crypto exchanges and just like any other tax software calculates all your assets gains losses imports data and files your tax document. This guide breaks down the implications of cryptocurrency transactions from a tax perspective to put you in a better. It is important to note that the tax rate on capital gains depends on the time of owning the asset which means that the period of the individual holding the cryptocurrency dictates the applicable tax rate.

Cryptocurrency Tax Calculation 2022. You can not save tax if you will trade in cryptocurrency in India after 01042022. Cryptocurrency tax is a new and emerging space in Canada with much speculation about different crypto scenarios and how they are taxed.

Income Tax on Crypto Currency India. There will be a 30 tax on cryptocurrency in India. Bittax uses a tax planning algorithm mechanism and helps you organize and manage all your tax liabilities and profits keeping in mind the standard protocols of IRS.

Scheme for taxation of virtual digital assets VDA Govt. Any income from the transfer of any virtual digital asset bitcoins and other cryptocurrencies shall be taxed at the rate of 30. But now the question is how to pay taxes on these transactions.

While cryptocurrency is an investment option and is becoming popular in India with each passing day the digital currency needs to be discussed from the view of a global tax perspective. The tax on cryptocurrencies introduced by the government of India has removed any ambiguity on its tax treatment. Calculate cryptocurrency tax in india o.

The boom in crypto trading is also. Cryptocurrency isnt just a Millennial or Generation-Z fad anymore as more institutions have started adopting this new-age asset class. Lets take a closer look at each of them.

India S Giant Crypto Market Will Come Under Taxation From Today

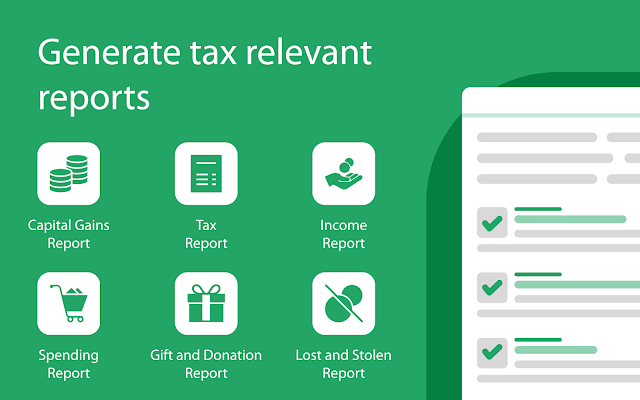

Cryptoreports Google Workspace Marketplace

40 Off Free Account 7 Crypto Tax Calculator Coupon Codes Apr 2022 Cryptotaxcalculator Io

Explained How Will Crypto Taxation Work In India

Cryptocurrency Tax Calculation 2022 What Will Be Taxed What Won T How And When Explained The Financial Express

Crypto Tax India Ultimate Guide 2022 Koinly

Cryptocurrency Tax Guides Help Koinly

These Indian Companies Accept Bitcoin Payments In India Goodreturns

India Gearing Up To Solidify Its Crypto Tax Laws

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win

Cryptocurrency Tax Guides Help Koinly

Petition To Reduce 30 Crypto Tax In India Garners Over 15 000 Signatures In Hours Finbold

Best Crypto Tax Software 2022 Reviews Comparison Coinmonks

Taxation Of Crypto Wazirx Blog

Cryptocurrency Tax Guides Help Koinly

Crypto Tax India Ultimate Guide 2022 Koinly